Eshita Gain | November 11, 2024

Retail investors are at a high risk of losses after investments in thematic and sectoral mutual fund schemes surged this year.

Sectoral schemes focus on companies in a specific industry and thematic schemes invest in companies that follow a trend.

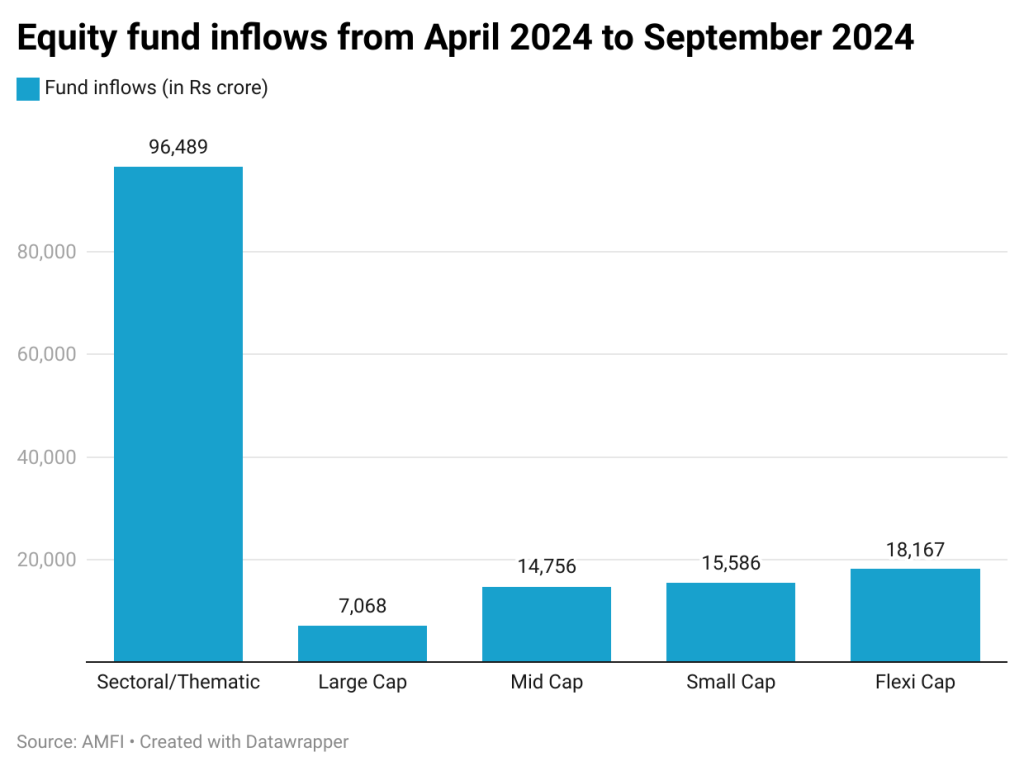

Among all equity mutual fund categories, sectoral and thematic funds have attracted the largest inflows, with a total of Rs 96,489 crore over the past six months, ending September 2024. The funds are classified as high-risk, high-return schemes by asset management companies (AMC) as they concentrate investments in a single domain.

Any downturn in the stocks of a particular domain can expose retail investors to losses. “New investors mindlessly invest in thematic and sectoral schemes to follow the herd mentality and incur losses when these schemes become overvalued” said Anirvan Roy, assistant vice president, HDFC Asset Management Ltd. The herd mentality grows out of a need to gain quick profits, which makes investors

flock to the same funds.

Post-Covid, people invested in the Information Technology (IT) sector funds owing to its growth. These funds are now underperforming, said Roy.

This rise in demand for sectoral and thematic schemes has contributed to 50% of the total inflows in equity funds, as per data by the Association of Mutual Funds in India (AMFI).

“There is an increasing investment in such funds because AMCs have continued to launch multiple such products every year,” said Roy.

The 2017 categorisation rule of the Securities and Exchange Board of India (SEBI) restricts AMCs from launching low-risk, diversified funds by limiting them to having only one fund per category. As a result,

of this change in policy, AMCs have started launching more thematic and sectoral funds.

AMCs have launched 1,031 thematic and sectoral schemes between April 2024 and September 2024, according to AMFI data. These schemes comprise about one-third of the total 3,197 equity schemes launched during the same

period.

Retail investors are concentrating their funds into thematic and sectoral schemes even as they are getting overvalued, said Shyam Sekhar, the fund manager who handles six registered portfolio management schemes (PMS) by SEBI. “This trend of crowding funds is not healthy and eventually the fund houses will carry the blame for the losses.” he said.

Emails and calls to SEBI did not elicit a response.