Alenjith K Johny

4 October 2024

Nidhin Narayan, a 30-year-old from Kerala, gave up his entrepreneurial dream of starting a computer training centre after multiple banks refused to grant Mudra loans, the government’s flagship, Small and Medium-sized Enterprise (SME) loan scheme.

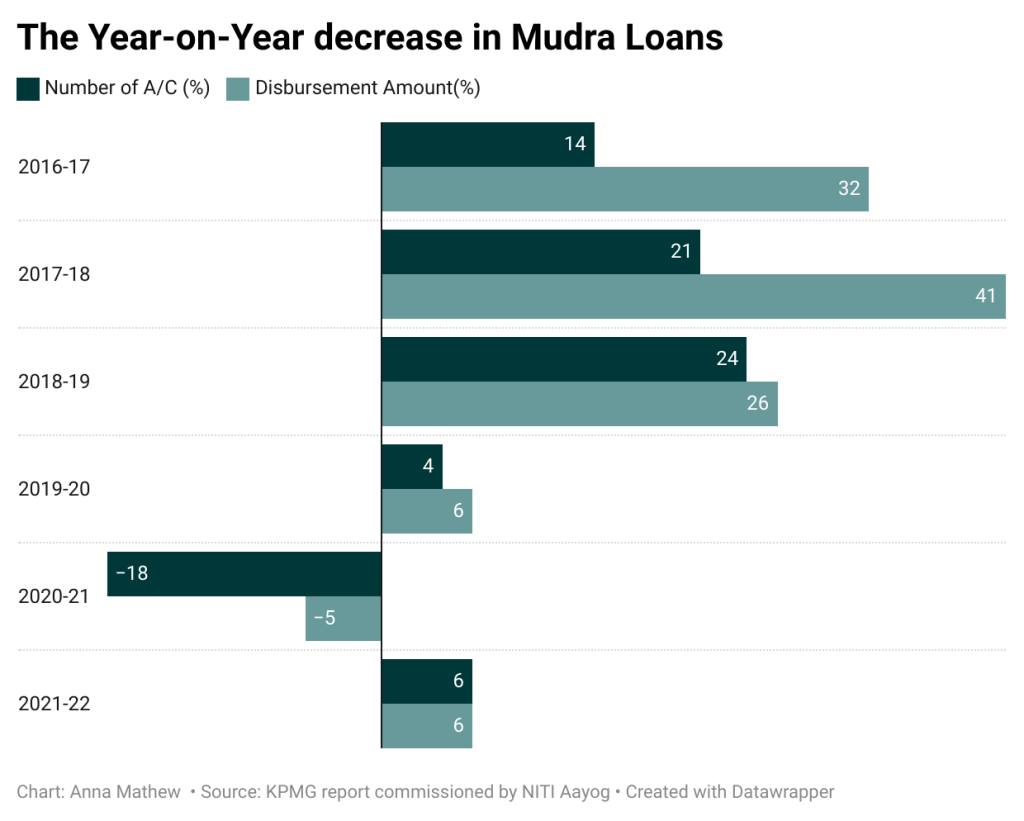

Narayan’s experience shows a broader trend. In Financial Year (FY) 2019 and FY2022, both the number of beneficiaries and the total amount disbursed for Mudra loans have declined. By FY2021, the year-on-year figures showed a18% decrease in beneficiaries and 5% decrease in disbursement, according to a 2023 NITI Aayog assessment report on Mudra loans. This decrease followed a rise in non-performing assets (NPAs) in banks over 60% from FY2017 to Rs 40,456 crore in FY2022.

“It was our dream project,” said Narayan, seeking financial assistance to open a computer training centre specializing in AutoCAD, a computer-aided design. “I approached multiple banks, both in and around our village, and even tried applying through agencies, but none of it worked.”

When Prime Minister Narendra Modi launched the scheme in 2015, he said that within a year, banks would queue up to give loans to Mudra applicants.

The scheme offers loans ranging from Rs 50,000 to Rs 10 lakh for micro, small, and medium enterprises. Applied through government portal, JanSamarth , these loans are named as Shishu, Kishore and Tarun, based on amounts granted. Most financial institutions including Microfinance Institutions (MFI) and NBFC provide these loans.

Narayan approached banks again for a loan in 2023, along with two of his friends, with plans to

launch their business and employ 15-20 staff members. However, he lost his dreams to settle as an employee at a similar centre in Kerala. “Banks were willing to offer me personal loans with collateral, but what’s the point of the Mudra scheme then?” he said.

The banks after Covid pandemic had a closer inspection into lending mudra loans. “Out of ten loans applied for Mudra at least five turns to NPA. After Covid-19 most banks including ours scrutinized almost every project that came to us,” said a Regional Bank Manager of South Indian Bank from Kerala in the condition of anonymity.

Data accessed through official sources show that out of Rs16.8 Lakh Crore MUDRA loans disbursed,

Kerala had Rs 1.9 lakh crore in NPAs as of June this year.

The Bottomline spoke to several bank managers about the current lending environment. They con-

firmed that the increase in NPAs heavily influences their decision-making process. “When we conduct inspections for submitted proposals, we sometime find no shops or enterprises at the specified locations” said Santo Antony, Bank of India Manager from Kerala.

Emails sent to the Ministry of MSME and Jitan Ram Manjhi did not elicit a response.