Paridhi Choudhary | 23 August 2024

Chennai: The Indian banking sector is facing a rise in cybercrimes as stakeholders have failed to prioritize cybersecurity, said Pavan Duggal, a cybersecurity expert on the threefold increase in cyber frauds in the financial year 2023-24.

The National Cybersecurity Policy of 2013 has not been implemented and it is ill-equipped to deal with current and emerging threats such as artificial intelligence and the use of deepfakes, said experts. The lack of understanding of technology among law enforcement is holding back the effective implementation of standard operating procedures.

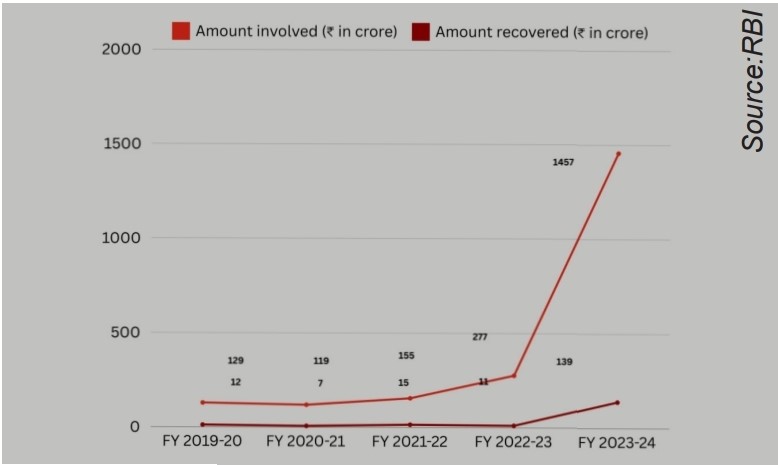

The Reserve Bank of India (RBI) data on the cyber frauds reported by the banks in the last five years. The amount involved in cyber fraud for the financial year 2023-24 has increased to Rs 1,457 crore from Rs 277 crore in the previous year.

Cybercriminals attacked C-Edge Technologies, a joint venture between Tata Consultancy Services (TCS) and State Bank of India (SBI), through ransomware on 30th July, leading to National Payments Corporation of India (NPCI) temporarily isolating over 200 Rural Reserve Banks and Cooperative banks. The attack did not result in any data breach. C-Edge Technologies provides software services to small and co-operative banks. Companies and banks do not want to update their cybersecurity system because it is expensive, said Pankaj Bafna, a cybercrime expert.

RBI has adopted various strategies to mitigate cyber fraud but cybercriminals have evolved in their way of committing fraud, especially after Covid-19. Cybercriminals are operating in semi-urban and rural areas and making use of artificial intelligence to automate their activities, posing challenges for banks, said Duggal.

Emails and phone calls to the official spokesperson of RBI did not elicit a response.

“All the stakeholders are waiting for the next big disaster to happen but cybercrime is a serious issue that requires attention from the judiciary, law enforcement, government, and the public,” said Bafna.