Saket Seth

Chennai

23 September, 2024

The Reserve Bank of India (RBI) has introduced stricter guidelines for Peer-to-Peer (P2P) lending platforms to prevent them from operating like financial institutions. P2P lending has surged in recent years in India. According to market research firm, Industry ARC, the Indian P2P lending market is expected to reach $10.5 billion by 2026, growing at a rate of 21.6 percent between 2021 and 2026. The platforms, however, irked the central bank as they operated as financial bodies going beyond the RBI’s mandate.

What are Peer-to-Peer (P2P) lending platforms?

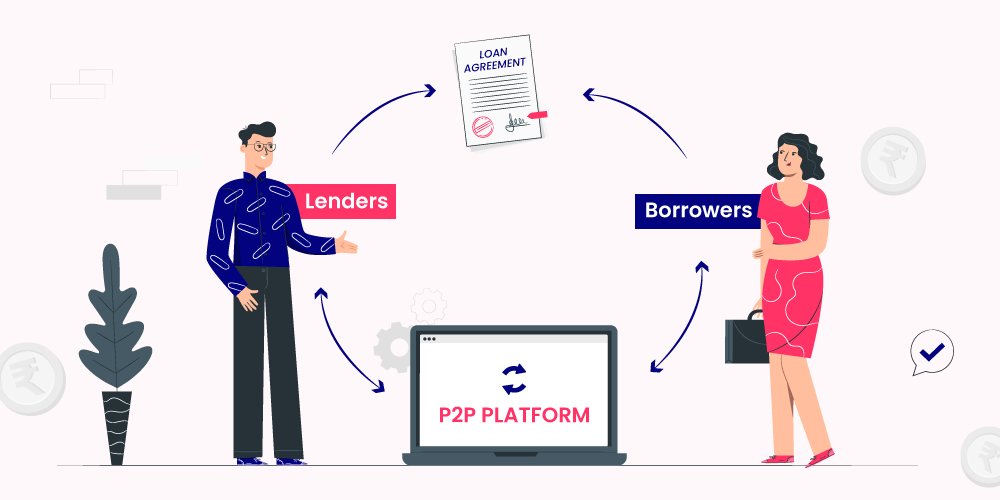

The Reserve Bank of India (RBI) classifies P2P lending platforms as Non-Banking Financial Companies – Peer to Peer Lending Platforms (NBFC-P2P). Unlike traditional NBFCs that can lend from their own balance sheet, NBFC-P2Ps only act as intermediaries, facilitating loans between lenders and borrowers without taking credit risk on themselves.

Any individual lenders willing to lend and earn interest can sign up on these platforms. Similarly, Borrowers willing to avail loan could register and submit a request for a loan. These loans are unsecured meaning they do not require any collateral. P2P platforms typically handle the transaction, including credit checks, loan disbursement, and repayment collections, while charging a fee for their services.

Why has RBI come up with updated guidelines?

RBI has come up with stricter guidelines for P2P platforms to prevent them from acting as a financial institutions.

Many such platforms started offering instant liquidity to lenders. If a lender wanted to withdraw money immediately, P2P platforms would transfer other lenders’ money to the one wishing to take an exit, a process known as secondary market transactions or instant liquidity.

These platforms are mandated to operate as intermediaries and like. financial institutions. It means that they cannot provide guarantees on loan repayments. Instant liquidity features often create an implicit guarantee, misleading investors into thinking their money is risk-free.

“No institution should be considered as a financial institution so far as it is not creating a loan book on its own balance sheet,” said, Rishabh Mastaram, Founder of RGM Legal.

If P2P platforms facilitate instant liquidity, they may effectively be functioning like NBFCs or banks, which are highly regulated. Such practices blur the lines between a regulated P2P model and an unregulated shadow banking system, raising systemic risk concerns.

The difference between the interest charged from the borrower and that given to the lenders is called spread. P2P platforms would pocket this spread and also use it as a security against defaults thus making the business attractive for lenders.

There is a difference between a lender and an investor. A lender gets back his money only after the borrower repays whereas an investor could have early withdrawals. In the lending and borrowing business, the method of early redemption is typically not supposed to be there.

P2P platforms are not supposed to deal with funds. They are platforms only meant to provide technical services for the proper execution of lending and borrowing. Their role is to bring in the borrowers and lenders together. They are not supposed to assume responsibilities like providing liquidity, insurance against loans, or safety. They should not assume the role of a financier.

What are the new guidelines?

RBI has barred P2P NBFC from assuming any credit risk– the entire loss of principal or interest or both shall be borne by the lenders. The P2P platforms must make adequate disclosure about it to the lenders.

The platforms shall also not cross-sell any insurance product with credit guarantee and credit enhancement.

RBI had earlier clarified that Default Loss Guarantee (DLG) is not permitted on NBFC-P2P platforms. These changes are consistent with the DLG directives, said Mastaram. “RBI is ensuring platforms should not take direct credit risk or underwrite any risk whatsoever for the loan facilitated on its platform.”

Further, the RBI has banned secondary market transactions, stating that funds in lender’s escrow accounts shall not be used for loan repayments, and those in borrower’s escrow accounts shall not be used for loan disbursements. These funds must remain in these accounts for no more than ‘T+1’ day from receipt. ‘T’ is the date on which funds are received into the escrow accounts.

RBI mandated that these platforms cannot guarantee loan recovery, promote P2P lending as an investment product, form strategic partnerships with other fintech platforms, and assume credit risk through DLG.

What could be the potential impact of new guidelines on the platforms?

Industry leaders fear that the ban on secondary market transactions (instant liquidity) between two lenders would disrupt the cash flow in the businees.

Another impact envisaged is with regards to T+1 guideline for managing money. There is apprehension that the time may not be enough to reconcile the money and accordingly process it.

Earlier P2P lending platforms would enter into strategic partnerships with other fintech firms to source customers and assume credit risk through DLG. A ban on strategic partnership is being seen as a threat to new entrants into the sector.

The big players in the sector have a first mover advantage as they have spent a lot of money in marketing, entered into strategic partnerships, sourced customers and established themselves, said Mastaram. “New entrants will find it difficult to compete with them since such partnerships and DLG are banned now.”