India taps into the growing market demand for ultra-long papers

By Abhishikta Sunkari | November 17, 2023

For the first time in history, India has introduced a long term 50 year bond to reduce the country;’s dependence on banks and to meet the rising demand from pension and insurance funds. Bank holdings of government bonds decreased to 38% in 2023 from 43% in the last five years, while Insurance holdings of these bonds rose to 26% from 23% in the same period, according to the ministry of finance. India is expected to raise Rs.6.5 lakh crore by issuing these bonds from October 2023 to March 2024. In its auction on November 3, the government sold 50-year bonds worth Rs.10,000 crore with a cut off yield of 7.46%. Also, green bonds worth Rs.20,000 crore will be issued for the second half of the fiscal year 2023-24.

Why did India issue these bonds?

The rise of the middle class in the country has been driving the growth of the life insurance and pension fund sectors. The sale of these bonds helps the government.

to extend the long term debt maturity and also to meet the requirements of large insurance companies like the Life Insurance Corporation of India. These insurance companies have increased their government bond purchases to Rs.1.39 lakh crore this year from Rs.1.10 lakh crore in 2022, as indicated by clearinghouse data.

How is the global 50-year bond market doing?

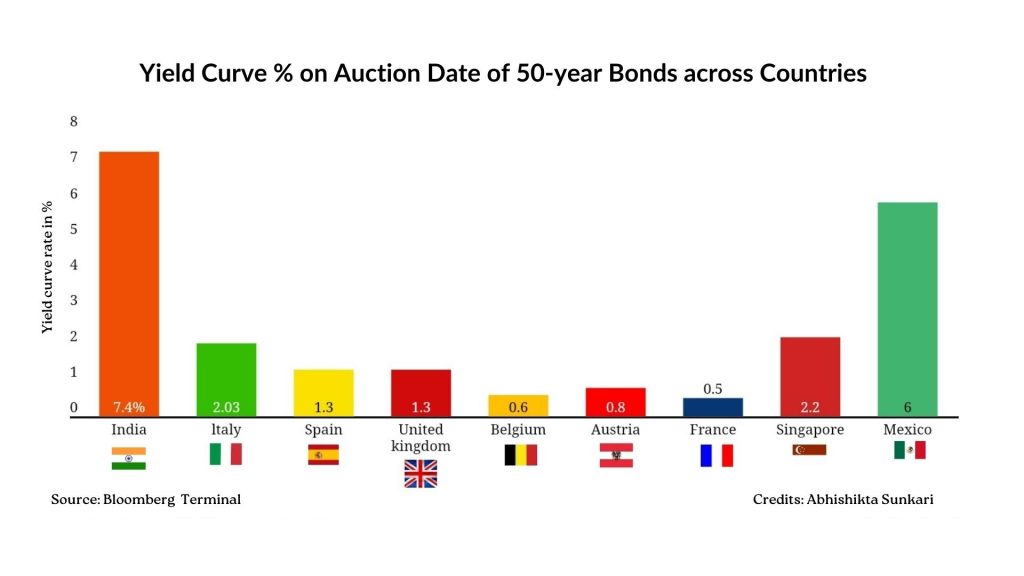

The 50-year bond market has already been introduced by other countries over the past few years. France, UK, Italy, Austria, Spain, Belgium, Indonesia, Singapore and Mexico are the only countries that issue 50-year-term bonds, according to Bloomberg.

Over the last two years, countries such as Belgium, Austria, France have seen a steady increase in bond yields while Singapore’s yields increased marginally, according to data compiled by bloomberg. Singapore’s yield curve is inverted because its short term interest rates are significantly higher than the long-term rates. This inversion demonstrates that short term risks are more concerning to bond investors than long-term ones.

What does JP Morgan’s Inclusion of India in GBI-EM mean?

J.P. Morgan will include India in the Government Bond Index Emerging Markets (GBI-EM) Index by June 2024. It is expected to provide India access to a sizable source of international financing which may contribute to lowering the nation’s financing costs in the long run. A Goldman Sachs report also says almost Rs. 4,000 crores of foreign investment is expected to flow into the Indian Bond Market over the next 1.5 years.