Personal Finance experts suggest smart investment strategies for uncertain times

By Roshni Shekhar | October 19, 2023

Securing financial future has never been more critical than now. Geopolitical volatility is increasingly impacting the markets. And, half the globe is staring at a slowdown. There’s a need for a strategic diversification of your portfolio for better returns. The Bottomline reached out to financial experts to share their investment strategies for new, young and existing investors.

Focus on Large-Cap Investments

Large-cap stocks are assets with a market capitalization higher than Rs. 8.3 lakh crore. They are advantageous for investors because their stability in size and tenure ensures steady dividend payouts to shareholders.

“One should have large-caps as a bulk of one’s equity fund portfolio and smaller components of mid-caps and small-caps,” said Shrikanth Bhagavat, managing director and principal advisor of Hexagon Wealth.

Diversified Portfolio is the Key

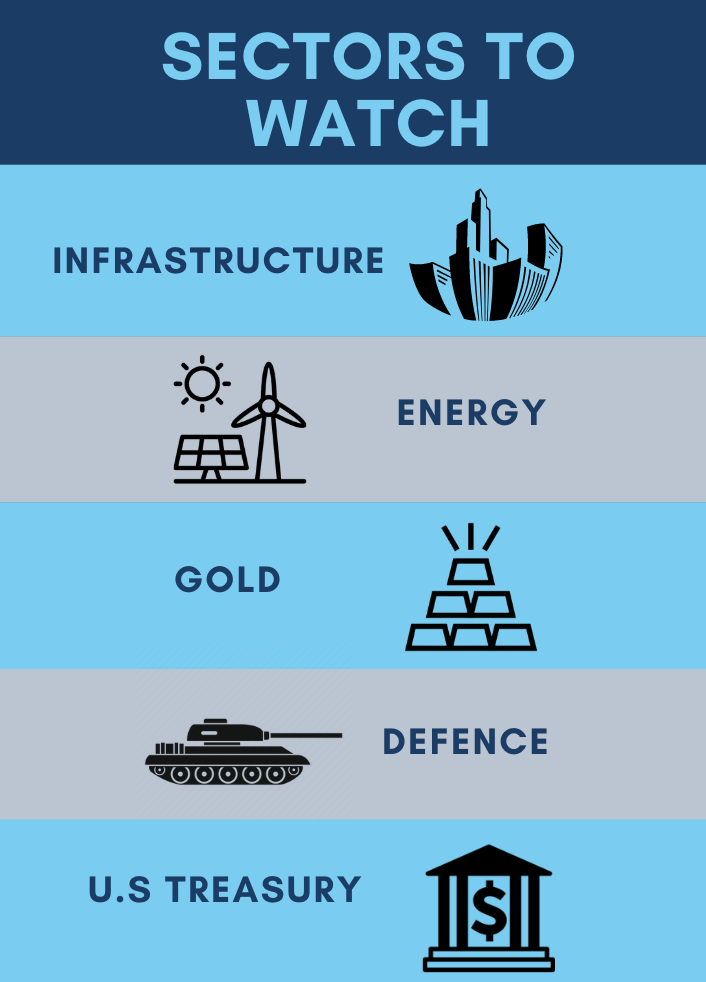

An investor must diversify across asset classes and also diversify within asset classes. A mix of equities, bonds, gold and international investment is a good option for a young investor, according to Vishal Dhawan, founder and chief executive officer, Plan Ahead Wealth Advisors.

Bhagavat suggests diversifying investments across government securities and corporate bonds with varying maturities to mitigate volatility. People in their mid-40s should invest in Nifty 500, said Suresh Sadagopan, founder of Ladder7 Financial Advisories.

Avoid IPOs

With a number of companies in the market, investors should be watchful of IPOs (Initial Public Offers).

“Hardly 5 to 10 percent of IPOs really give a return in long run. IPOs will keep flooding the market. The best thing for investors is to avoid IPOs,” said Vijay Kedia, founder and managing director at Kedia Capital Services Pvt. Ltd.