By Khushi Malhotra | November 17, 2023

The Securities and Exchange Board of India (SEBI) raised an alarm after a record number of small and medium enterprises got listed this year, creating a bubble of demand.

There was an unusually high subscription for SME Initial Public Offerings (IPOs) this year, with 37 companies oversubscribed more than 100 times, six over 300 times, and one subscribed 713 times, according to data from Primedatabase.com. The companies listed on the BSE SME exchange and Nifty Emerge together raised over Rs. 3,385 crore ($408 million), the highest ever.

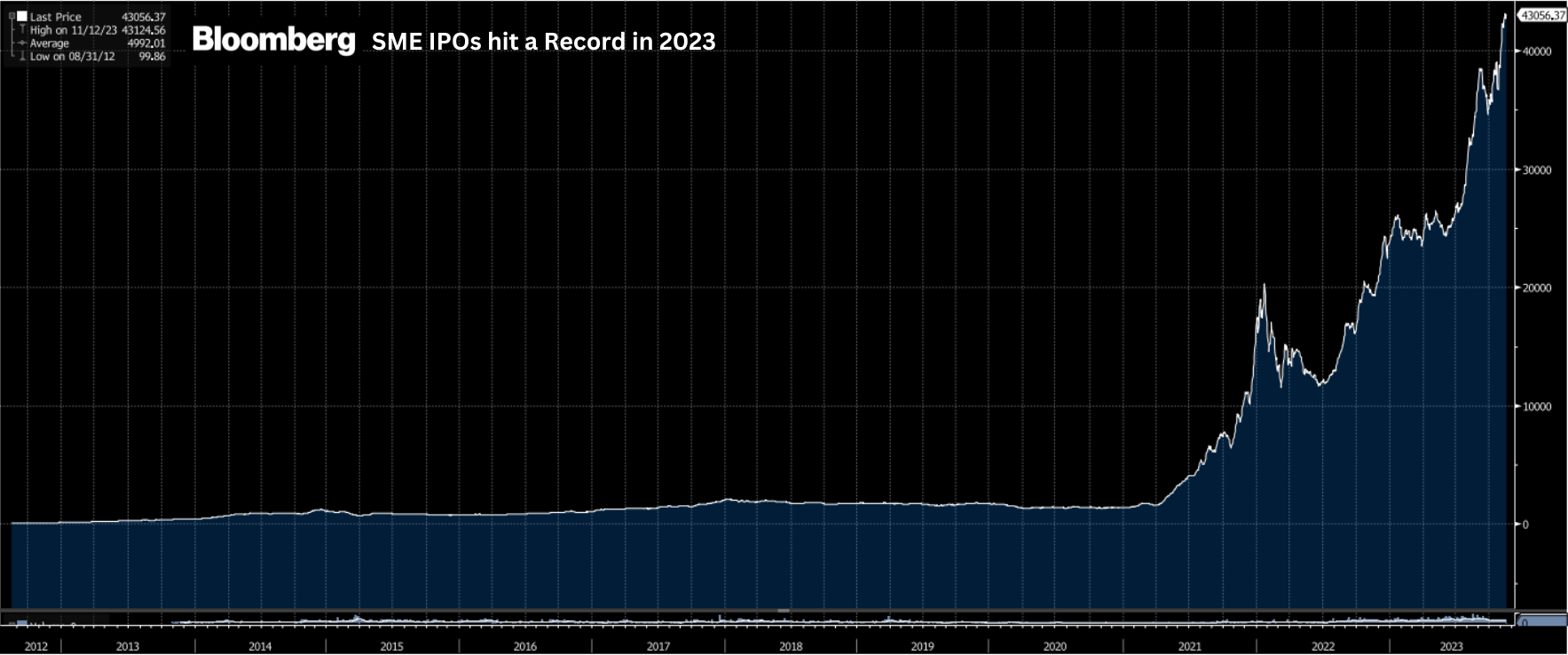

This month, the BSE SME IPO Index hit an all-time high at 43,397.52 as high listing gains attracted retail investors. “SME listing gains were almost double the mainboard IPOs,” said Yogesh Supekar, former executive director at Dalal Street Investment Journal.

Instances of extreme oversubscription in some of the new SMEs has raised questions, said Shubham Kumar, a SME relationship manager and credit analyst. The Securities and Exchange Board of India (SEBI) is actively investigating these cases.

SEBI increased scrutiny over the SME sector to prevent speculative trading and safeguard the interest of the investors. The regulator, along with the National Stock Exchange and the Bombay Stock Exchange, launched two oversight frameworks – A short-term additional surveillance measure (ST-ASM) and a Trade-for-Trade framework.

As of now, 12 SMEs have been added to the ASM list as per the NSE website. SEBI is yet to release a detailed report on the investigation and did not respond to emails. Under ASM, which included Adani after the Hindenburg case, the regulator adds some additional checks and balances to stocks with excess volatility, said Pranav Haldea, the managing director of Primedatabase.com.

Out of the 154 new SMEs listed year to date, as many as 40 companies were trading below their offer price as of November 16, according to data from Bloomberg and Primedatabase.com.

“The ongoing investigation is raising concerns among investors, triggering heightened volatility and diminishing confidence,” said Kumar. “This uncertainty, combined with potential regulatory actions, has led to a sell-off, causing SMEs to trade below their IPO levels.”

The trading volumes of these SME IPOs when they get listed are very thin, said Haldea. Therefore, they may have been manipulated, he said. Promoters collude with bankers and brokers to drive the price of such IPOs up and then eventually liquidate their entire stake, said Haldea. The individual retailers are then left holding the stocks and are unable to exit, he said.

Investors need to be extremely wary when looking at these companies and need to do their due diligence, said Haldea.