Growth in M&A will move from startups to financial services

by Auhona Mukherjee | August 30, 2023

The Byju’s meltdown ‘spooked’ investors and slowed the Indian merger and acquisitions (M&A) market in the first half of the year, said Bindi Dave, partner at Wadia Ghandy & Co., the law firm that handled the largest deal announced in India in 2022.

The number of M&A deals fell by 44% in the first half of 2023, with 749 deals completed this year compared to 1,338 deals in the first half of 2022, according to data compiled by Bloomberg.

Market valuations have not been ‘up to the mark’ as a result of investors being ‘spooked’, said Dave. In the previous fiscal, Wadia Ghandy & Co. held the fourth rank by market share of law firms handling M&A deals in India, according to Bloomberg’s league table. It handled the merger of Housing Development Finance Corporation (HDFC) with HDFC Bank, announced in 2022.

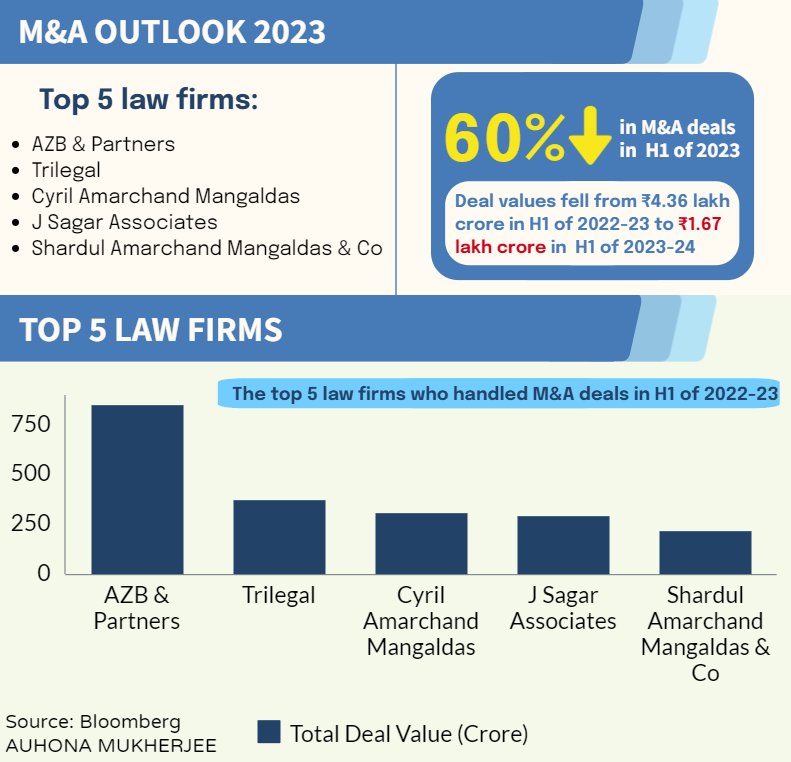

AZB & Partners led the M&A deal activity this year, followed by Trilegal and Cyril Amarchand Mangaldas. J Sagar Associates (JSA) was the new entrant in the list of top five law firms handling M&A deals in India, according to Bloomberg data. The law firm was involved in major deals, including Baring EQT’s acquisition of HDFC Credila & Indira IVF.

M&A activity has slowed to a trickle in recent months due to economic downturns, persistent inflation, and a decline in high-value transactions, said JSA.

The value of completed M&A deals in the first half of the fiscal year 2023-24 plunged 60% to Rs. 1.7 lakh crore ($20.3 billion) from a year ago. Total deals value, including pending and proposed deals in first half of the fiscal year 2023-24 fell more than two-thirds to Rs. 3,54,131 crore ($42.9 billion), compared with Rs. 11,18,528 crore ($135.5 billion) from a year ago, according to Bloomberg.

The decline of Byju’s has cautioned investors and top law firms such as Khaitan & Co. are spending more time on due diligence, negotiations and deal closures amidst the slowdown. The law firm also witnessed a reduced risk appetite among investors.

Byju’s was once the poster child of India’s booming startup ecosystem, valued at around Rs. 1,81,606 crore ($22 billion) at its peak. The company’s valuation plunged to Rs. 69,340 crore ($8.4 billion) amid concerns about its high debt levels and slowing growth.

Recently, the Enforcement Directorate (ED) reportedly investigated the edtech giant for alleged foreign exchange violations. Several top executives have left the company in recent months, with WhiteHat Jr, Chief Executive Officer, Ananya Tripathi’s resignation being the most recent.

JSA is optimistic about a rebound in the coming months. It has projected a positive outlook for the rest of the financial year, owing to diminished market volatility and consistent interest rates. Law firms also expect an increase in foreign investment inflow in the country.

“With liberalisation of the overseas investment regime, all global players are developing an India strategy. We are witnessing a high number of queries about setting up or investing in India,” said Rabindra Jhunjhunwala, partner at Khaitan & Co.

Private equity will be “buzzing” around active pharmaceutical ingredients, specialty chemicals, and contract manufacturing, Jhunjhunwala said.

He projected this after Torrent Pharma joined the race against Blackstone and Baring Private Equity to buy the entire 33.47% promoter stake in Cipla, India’s third-largest drug producer.

“Growth will happen as investors will diversify their capital. It will largely move from the start-up sector to the financial services sector,” said Dave.