Apratim Sarkar | August 31, 2023

India’s market regulator, the Securities and Exchange Board of India (SEBI), informed the Supreme Court (SC) that its investigation into the financial irregularities of Gautam Adani’s company was completed on August 25,2023.

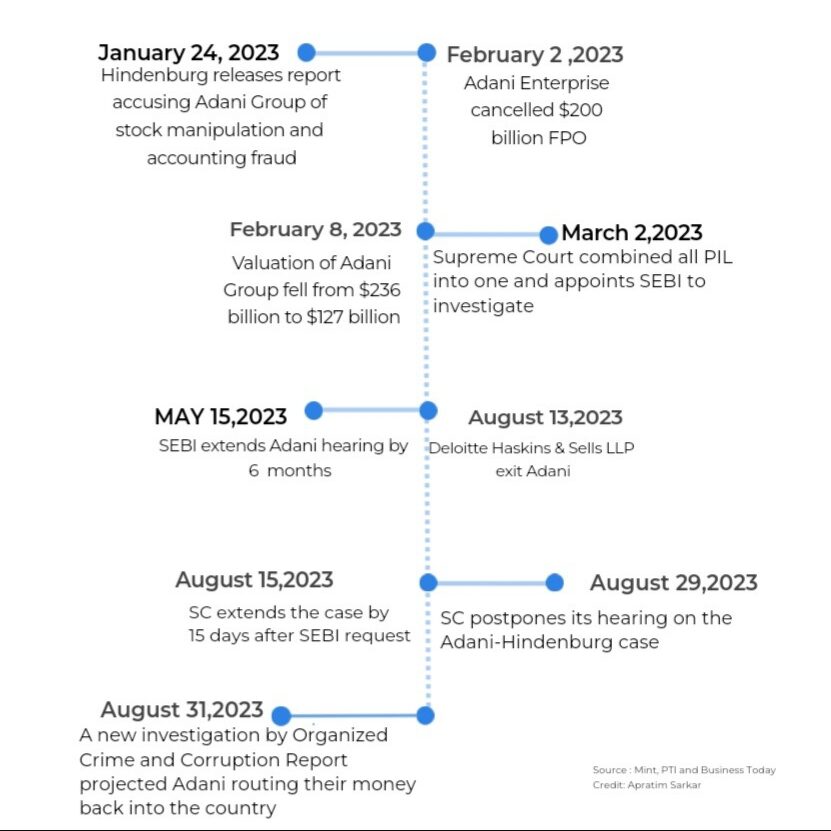

Timeline

What happened at the SC hearing?

The SEBI probe was launched in January 2023 following the Hindenburg Research report, which accused the Adani Group of corporate fraud and stock price manipulation. SEBI has since been investigating the allegations, which include possible violations of minimum public shareholding norms, linked party transactions, and insider trading.

The Supreme Court ordered SEBI to investigate the claims and report its findings to a six-member panel established in March, made up of a retired judge and experienced bankers.

The Supreme Court, on August 29, rescheduled the hearing of the case involving the status report provided by SEBI.

SEBI informed the apex court that it is currently awaiting data from five offshore tax havens to identify the true beneficiaries behind foreign investors engaged with the conglomerate, reported the Press Trust of India (PTI).

What were the highlights of the SEBI probe?

On August 14, SEBI submitted a request to the SC asking for an additional 15 days for submitting the investigation report on Adani Group, claiming that it had finished looking into 17 of the 24 transactions it had taken up for investigation.

The probe is the latest in a series of challenges facing the Adani Group. The group has also been under scrutiny from the Competition Commission of India and the Central Bureau of Investigation.

The Adani Group has denied all the allegations against it. The companies listed under it lost more than ₹8.2 lakh crore ($100 billion) in market value earlier this year after U.S.-based Hindenburg Research raised several governance concerns, according to PTI.

What were the allegations against the Group?

The Hindenburg report stated that the business overstated its riches and understated its liabilities by using unethical accounting techniques.

Apart from stock manipulation, the Hindenburg report also criticized the Adani Group for its environmental practices, including vast deforestation, endangering delicate ecosystems, and contaminating groundwater and the atmosphere. Adani Group disregarded community concerns and broke several environmental regulations, according to reports.

The conglomerate called the allegations a “calculated attack on India.”

How did it impact Adani stocks?

The market capitalization of the Adani Group decreased from ₹ 19 lakh crore on the day before the Hindenburg Research report’s release to ₹ 10 lakh crore on February 3.

The ₹ 19.5 lakh crore ($236 billion) company’s valuation fell to ₹ 10.5 lakh crore ($127 billion) on February 8. Adani Enterprises, the flagship company of the Adani group, fell more than 8% to ₹ 1,765.00 in early trade.

What is next for Adani?

A new investigation by the Organized Crime and Corruption Report Project has proved that the Adani Group was routing their money back into the country.

Nasser Ali Shaban Ahli and Chang Chung-Ling, who are associates of Vinod Adani, were revealed to be collecting and trading large trade positions in Adani stocks.

The outcome of the SEBI probe could have a significant impact on the Adani Group. Market Expert claims that if the regulator finds evidence of wrongdoing, the group could face heavy fines or even be delisted from the stock market. The probe is also seen as a test of SEBI’s willingness to crack down on corporate wrongdoing.