-Rumi Chakraborty | February 2023

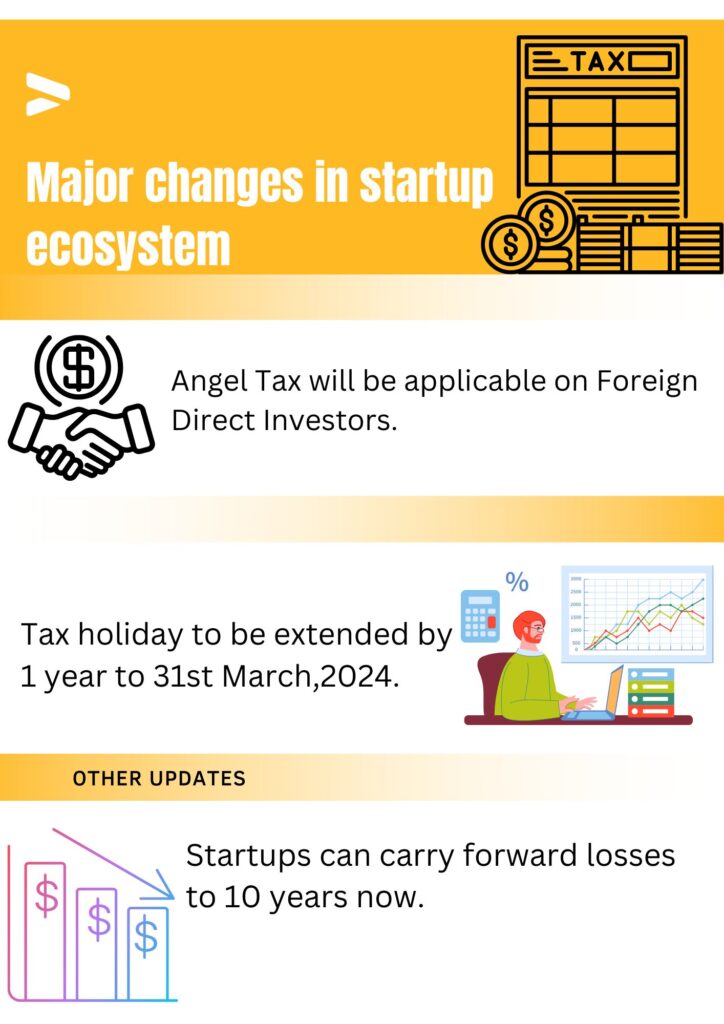

The extension of the angel tax provisions to foreign transactions is likely to impact global investments in Indian startups.

From financial year 2023-24, start-ups will need to pay taxes on investments they receive from outside the country, said Finance Minister Nirmala Sitharaman in her Budget speech.

Earlier, startups were levied angel tax only when shares were issued above their discounted cash flow value to Indian investors. The investments received from non-residents of India were not subjected to section 56(2) (vii b) of Income Tax Act, known as the angel Tax.

“Unicorns will now try to raise money overseas and create a subsidiary in India as they will not need to pay the angel tax in foreign countries,” said Abhimanyu Radhakrishnan, managing director of Qyuki Digital Media.

Most Indian start-ups are dependent on overseas investment for their funding. An angel tax on FDIs will impact the fund-raising by these startups.

“The implementation of an angel tax on foreign direct investment (FDI) might reduce the growth of the start-up ecosystem as entrepreneurs will be sceptical to invest in Indian startups,” said Sneha Karmakar, chartered accountant working with Deloitte Financial Advisory Services LLP. Under the Foreign Exchange Management Act (FEMA),1999, the valuation norms of startups prescribed the minimum floor for the purpose of bringing in FDI.

The Income-tax authorities would now seek to tax any premium above the fair market value of the shares. Tax departments are expected to examine FDI in startups which may result in litigation going forward.

The tax will facilitate startups to make salary advances, create a subsidiary, engage in mergers and acquisitions, and contribute to an employee stock ownership plan (ESOP) which was not allowed when angel tax was not levied on FDIs.

“More startups are now open to the option of making salary advances to their employees, which they lacked before, “said Karmakar. Startups registered under the Department for Promotion of Industry and Internal Trade (DPIIT), however, will continue to be exempted from angel tax regulations.

The Finance Minister has announced an extension for the startup tax holiday policy by one year to March 31, 2024.

This year’s Budget has also extended the benefit of carrying forward losses to 10 years from the date of incorporation of the firm. Earlier, losses could be carried forward for seven years.