-Sashind Ningthoukhongjam | December 3, 2022

Treasury-Bills (T-Bills) are giving higher returns than most bank fixed deposit (FD) rates, making the risk-free security an attractive investment option for retail investors in the short term.

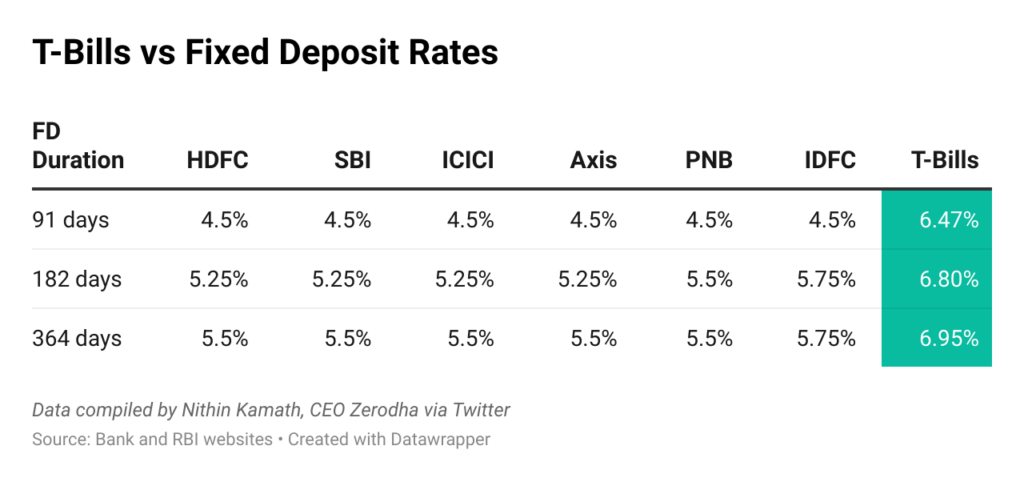

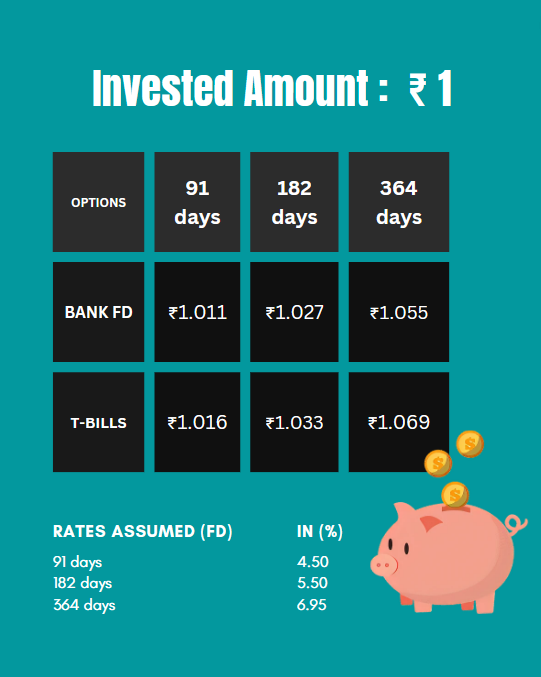

T-Bills currently provide a 6.47 percent annualized rate for 91 days, 6.80 percent for 182 days, and 6.95 percent for 364 days. These rates are higher than FD rates offered by large banks such as HDFC, SBI, ICICI, Axis, PNB, and IDFC Bank.

The spike in the T-bills rate is due to the central bank’s policy of raising interest rates to control inflation. When the RBI raises the interest rate, government securities are the first ones to follow whereas FDs take longer to revise rates upward.

What are T-Bills?

T-Bills are Government securities (G-secs) with a maturity of one year or less. They’re issued by the Reserve Bank of India (RBI) to fund the government’s borrowing needs. G-secs with a maturity of more than one year are called bonds.

T-bills are considered safer than FDs as they are backed by the Government of India.

All G-secs are traded in the market and, hence, their price fluctuates. This means one might not get the desired price if one decides to sell before the maturity date. The price at which a G-Sec trades in the market depends on demand and supply, which is usually affected by interest rates

How to invest in T-Bills?

Individual investors can place an order for buying T-bills through their demat accounts using a brokerage firm. A demat account is used to hold securities in electronic format.

Until recently, only banks and large institutions could invest in G-secs with a minimum investment amount of Rs 5 crore. To make the secure investment accessible to retail investors, the RBI in collaboration with National Stock Exchange, introduced a system last year through which retail investors could buy G-Secs directly from the central bank.

Retail investors need to invest at least Rs 10,000 to place a T-Bill order with the RBI.

A short-term capital gains tax is applicable on T-Bills and the rate is as per the tax slabs that the investor falls under.

What are experts saying?

Given current yields, T-Bills are a much better option compared to the FDs of major banks. Earlier, the minimum amount for investing in T-bills was Rs 5 crore; for lesser values, you could only buy and sell in the Odd Lots market—where there was almost no liquidity. Now, the stock exchange has come up with a system that allows retail investors to invest in T-bills.

–Nithin Kamath, Founder, and CEO, Zerodha

The current yields provide a good opportunity to buy T-bills but not many people are familiar with them. For instance, senior citizens who have been investing in FDs through banks may not feel comfortable investing through a brokerage account. Also, brokers charge a small fee for transactions but the returns will still be higher vis-a-vis FDs.

-Surya Bhatia, Managing Partner at Asset Managers

Whilst there is no credit risk with G-secs, investors need to be aware that there could be market fluctuation impacts, especially when the interest rate goes up. This can be solved by holding the security until the maturity period.

(When rates go up, buyers will demand the same rate from traded securities, and thus, prices of earlier securities have to go down to match the current yield.)

-Vishal Dhawan, Founder, and CEO, Plan Ahead Wealth

(*Rates are subject to change after this article)