-Sashind Ningthoukhongjam | October 21, 2022

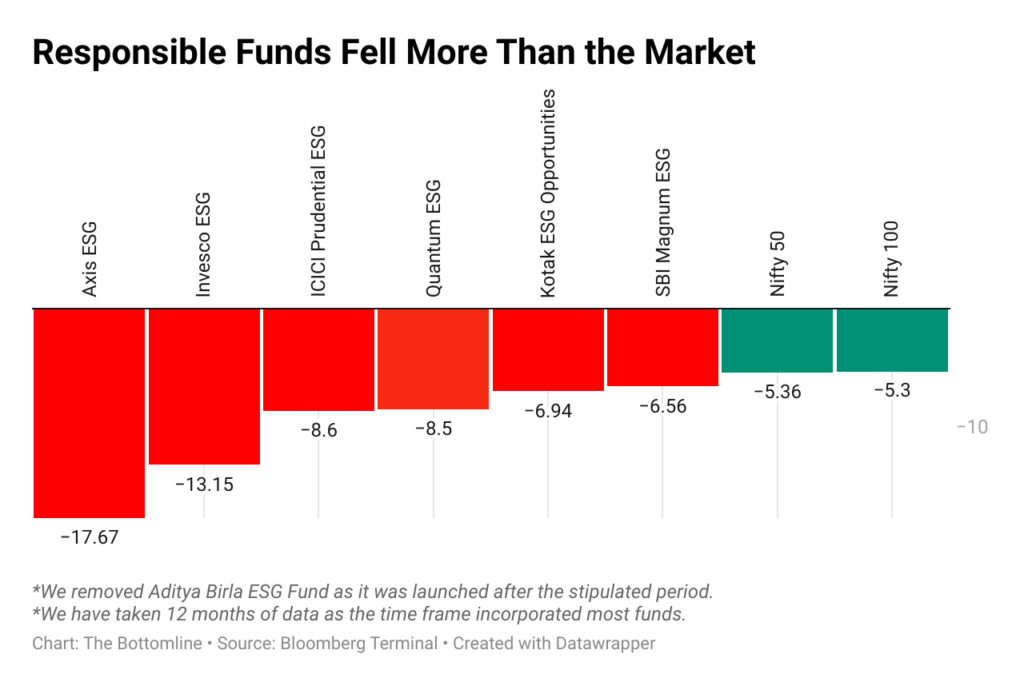

ESG funds in India failed to beat market indices as non-ESG stocks turned out to be the high performers.

Indian Tobacco Company (ITC), Adani Enterprises, and Coal India were among the best-performing stocks in the Nifty 50 index in the past 12 months. ESG funds did not have exposure to these companies as their sustainability mandate forbids investments in tobacco or coal mining firms.

All seven ESG Mutual Funds underperformed relative to the Nifty 50 and Sensex 30 indices in the past 12 months. Quantum ESG fund, the only fund that beat the market index since its inception, has assets under management of Rs 64 crore or just 0.6% of the total funds managed under the sustainability theme in India.

“With ESG, you add constraints to your investment choices, and a constrained optimal should give lower expected returns, over longer periods, than an unconstrained optimal,” said Aswath Damodaran, professor of finance at New York University’s Stern School of Business. “ESG underperformance is not a bug, but a feature.”

The underperformance of ESG funds follows a period of rising investor interest in responsible funds. Six out of the seven ESG funds were launched in the past two years as the concept of responsible investing became popular in Europe and the United States.

“A rush of new funds typically happens at near-term market tops,” said Anoop Vijaykumar, fund manager at Capitalmind, alluding to the rise of ESG funds in India to the western markets.

(*We excluded Quant ESG Equity Fund and passive ESG funds for this article.)