-Srushti Vaidya & Jas Bardia | February 1, 2023

India’s benchmark bond yield fell as the union government narrowed its fiscal deficit target for financial year 2023-24.

The country’s bench-mark 10-year government bond maturing in August 2032 fell 91 basis points to 7.37 per cent at the day’s close on Budget day. Finance Minister Nirmala Sitharaman estimated the fiscal deficit to be 5.9 per cent of Gross Domestic Product (GDP), down 50 basis points from this year’s revised estimates.

The drop underscores a positive sentiment in the bond market as the central government has managed to lower its fiscal deficit target.

“The (bond) market knows that the fiscal deficit is lowering,” said Venkatakrishnan Srinivasan, founder and managing director, Rockfort Fincap LLP.

Srinivasan said the fall in yield is a temporary response to the Budget. The central bank’s repo rate announcement will determine the future change in bond yields, he said.

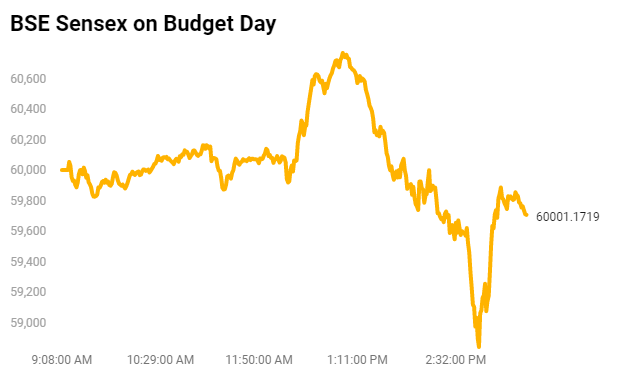

The sensex gained marginally 0.27 per cent, closing the day at 59,708. The Nifty Index fell 0.26 per cent, closing the day at 17,616 even as banking stocks gained.

Analysts said the Budget was on par with market expectations and investors factored in the lack of any big bang announcements.

“The market did not gain or lose drastically as it was a balanced Budget and in tune with what we had predicted,” said an analyst with India Infoline Limited (IIFL) who did not wish to be named.

The IIFL analyst said insurance stocks, including PB Fintech, which owns Policy Bazaar, and SBI Life, did not perform well after the government announced a tax cut in the new tax regime.

SBI Life Insurance Company ended the day 8.61 per cent lower at a seven-month low of Rs.1,109. Policybazaar hit a four-day low of Rs.391 before closing at Rs.402.

Nestle India, Tata Consultancy Services, UltraTech Cement, HDFC, and HDFC Bank led the gains whereas Maruti Suzuki Ltd., Bajaj Finserv, Bajaj Finance, IndusInd Bank and Titan Company were the biggest laggards.