-Ashokamithran.T | February1, 2023

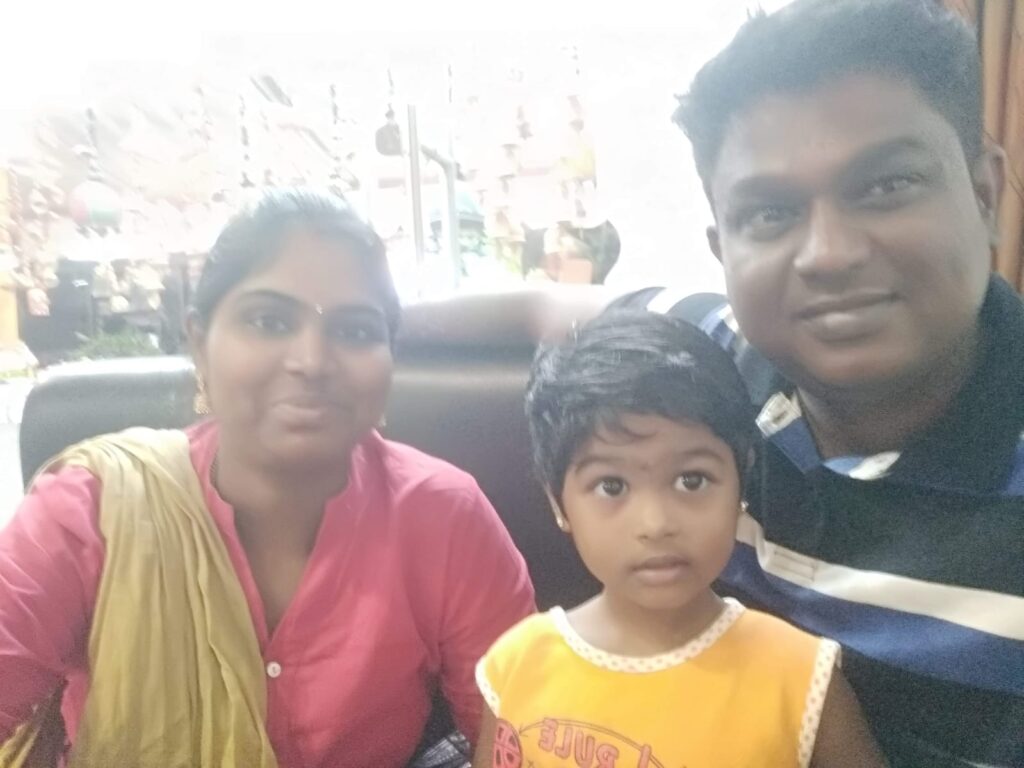

S. Pandian, a 35-year old technical trainer at an engineering firm who has an annual income of Rs.8.7

lakh per annum, said he will not shift to the new tax regime which has lower tax outgo.

The Finance Minister in the Budget for fiscal 202324 has increased the maximum tax-free slab to Rs.7

lakh, to nudge tax payers like Pandian to opt for the new tax regime. He however, says that he will lose

out if he chooses the new regime as all his deduction claims will now not be eligible. Pandian claimed an

exemption of Rs.1.5 lakh on long term investments under Section 80C of the Income Tax Act, 1961. He

has invested Rs. 1 lakh on life insurance, and around Rs.30,000 in the Sukanya Samridhi Yojana for his

sixyear-old daughter. In addition, he claims a Rs.58,000 deduction on house rent allowance. A shift to

the new regime means he will have to forego all the deductions, despite the Rs.8,000 tax saving.

In the old regime, where he was part of the 10 per cent tax bracket, he paid Rs.36,000 annually as

income tax. Though he would be paying a tax of only Rs.28,000, the cost of insurance premiums and

house rent would now add to the monthly expense of the family. “If I choose the new regime, I will not

have long term investments,” said Pandian.

“Except the fact that it is easier to file the taxes, there is not much benefit under the new regime.” In the

new regime, he comes under the 5 per cent tax bracket.

Pandian is a part of over five crore people who will decide between the old and the new regimes. The

changes “will be very good for those who do not have any claimable deductions like home loans,” said

Suresh Sadagopan, Managing Director, Ladder7 Wealth Planners. The idea of investing is to make long-

term savings a good financial practice and not merely for tax benefits, said Sadagopan.

On the one hand, taxpayers like Pandian express their apprehensions about the new regime, while

experts like Sadagopan say that they are “building mountain out of a mole hill.”