Kanchana Chakravarty | October 21, 2022

Indian benchmark indices, Sensex and Nifty, closed for Samvat 2078 today, performing the worst in seven traditional Hindu calendar years.

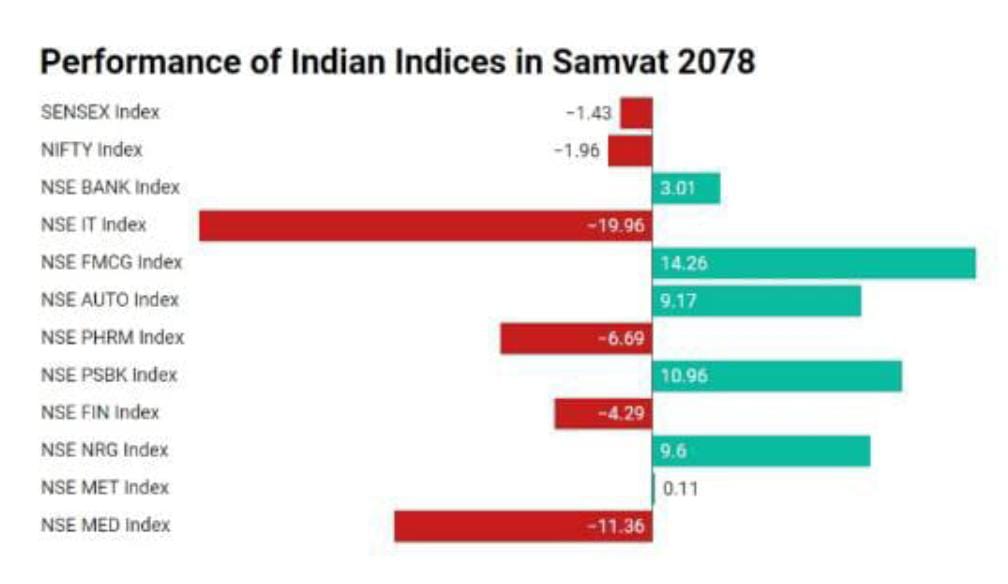

For Samvat 2078, Nifty fell by 1.90 per cent and Sensex fell by 1.26 per cent. On Monday, at the start of Samvat 2079, Indian stock markets will be open for ‘Muhurat’ trading between 6:15 pm and 7:15 pm.

This is India’s worst performance in seven Samvat years, however, Indian equities have performed better than most global indices this year. In Samvat 2078, the MSCI Emerging Markets Index lost 31.83 percent while the MSCI World Index lost 24.67 per cent. “Today we’re almost at 90 percent plus premium over the emerging markets,” said Rusmik Oza, Executive Vice-President of Kotak Securities. Historically, India has traded at around 50 to 55 per cent premium over the emerging markets on average for the last 15 years,” he added.

Experts said that the next six months for the Indian markets will be challenging, led by high food and fuel inflation.

“Inflation will continue to have a pronounced effect on EMI (equated monthly instalment) driven sectors such as electronics, cars, houses,” according to Harsh Tewaney, Associate, capital goods sector at Yes Securities.

Export-heavy markets’ such as IT will continue to fall in Samvat 2079 as the demand is low, he said. It has been a difficult year for equity markets and other asset classes, owing to geopolitical issues, Fed rate hikes and high inflation. Foreign Institutional Investors have pulled out Rs.1,79,939 crore from Indian equities as on October 2022.Banking, Financial Services and Insurance (BFSI)–which accounts for 35 per cent of the Nifty index–will give maximum returns in the coming year, said Oza. This will be followed by FMCG and IT, which are poised to give good returns for the next six months, he added.

The indices gained marginally on Friday due to the expectations of good quarterly results of banks. The Sensex gained 0.18 per cent to end the day at 59,307.15 and Nifty gained 0.07 per cent to 17,576.30.