Jas Bardia | December 2, 2022

Price correction in the stock market and moderating inflation over the next year might cause bond yields to drop, say experts

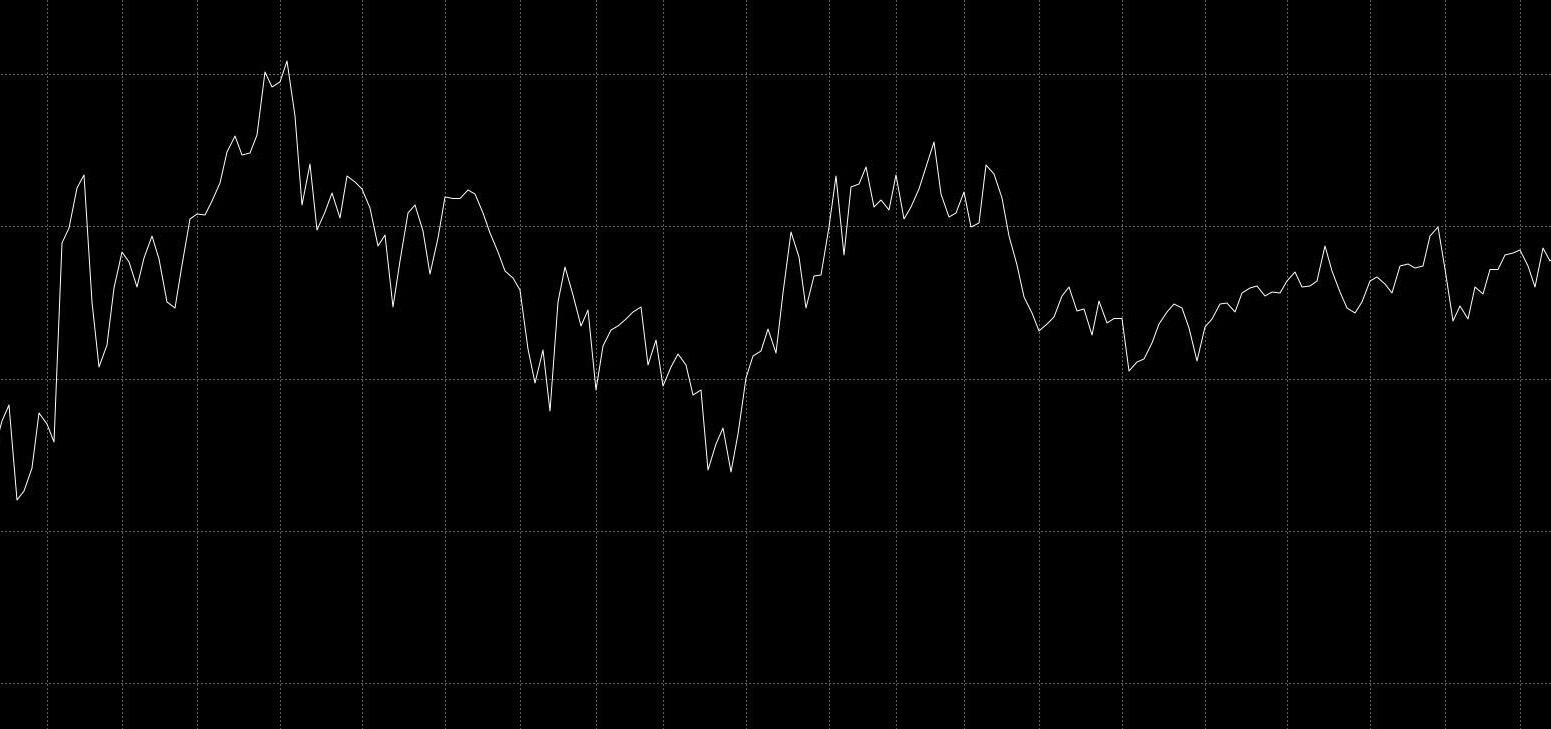

The yield on India’s benchmark 10-year bond maturing on August 2032, is expected to drop by 40 basis points (bps) by the third quarter of financial year 2024, if India’s inflation eases and the US Federal Reserve reverses its monetary policy, said analysts.

Analysts in a Bloomberg survey have predicted India’s benchmark bond yields to drop in the coming year, despite a stable stock market and high interest rates. India’s 7.26 percent bond yields around 7.25 percent on December 1, 2022.

The Indian government will also likely issue bonds at lower interest rates or might not sell many long-term bonds because it wants to keep the dollar-rupee exchange rate in check, said Rohit Pawar, fixed income analyst at Nomura Services India Pvt Ltd. India has been using its forex reserves to increase the Indian rupee’s demand and reduce the American dollar’s demand to bring down the exchange rate. It is mulling over selling lesser government bonds at high prices to increase demand for the rupee and thereby yields are expected to come down, Pawar said.

Long-term bond sales will be determined by the upcoming Reserve Bank of India (RBI) monetary policy committee’s decisions on further rate hikes, said Venkatakrishnan Srinivasan, founder and managing partner of debt advisory firm Rockfort Fincap. He estimated the yields to drop below the estimated figures of 7.06 percent. Analysts are unsure on India’s inflation peak.

“If RBI hikes rates or moderates them and if inflation comes within the comfort zone, there is a possibility of government securities coming down below 7 percent,” said Srinivasan. “Government borrowing and state development loans (SDL), which are lesser than the actual calendar borrowings, will also play a role.”

High interest rates prompt bond yields to increase and prices to drop. A stock market rally can also prompt funds to chase riskier bets equity rather than safer government bonds. Subsequently, bond yields are bound to go up to compensate for the lack of sales. Analysts are expecting inflation to cool down in the next four quarters.

“They are probably expecting a price correction in the stock market in the same period,” If those two assumptions are made, interest rates will come down, the stock market returns will moderate and therefore, bond yields will tend to come down,” said Abhijit Mukhopadhyay, senior fellow at think-tank Observer Research Foundation (ORF).

Mukhopadhyay said moderate inflation in the range of four percent with an error margin of two percent will have a favourable impact on oil prices which would have been factored in by analysts in their estimates.

Srinivasan said oil prices above $90 are tough for India because excise cuts might not help in easing inflationary pressures. “Till the time oil marketing companies recover their losses, even if they reduce the oil prices massively, it is going to be a problem to bring down inflation,” Srinivasan added.