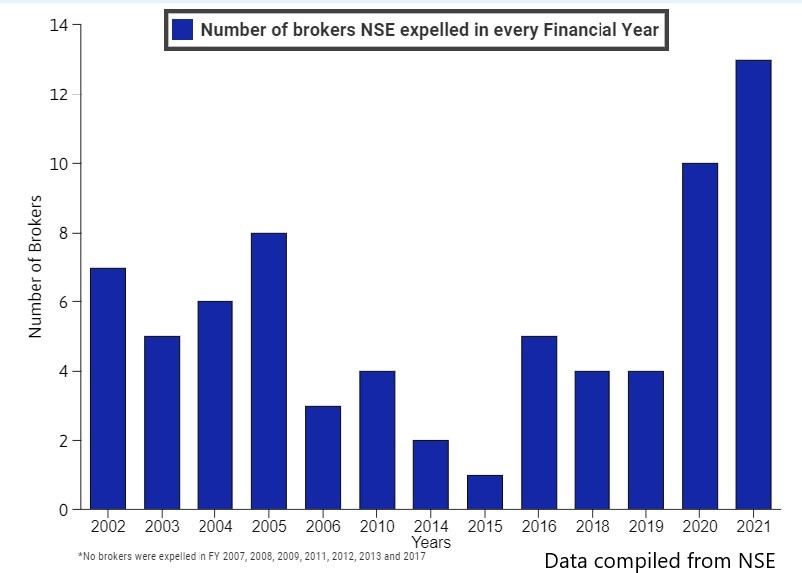

The National Stock Exchange of India (NSE) expelled 13 brokers in the year ended March 2021, the highest in two decades, as reports of malpractices flooded the industry.

In a country with less than 2% retail equity participation, loss of money due to broker-bans burns investors for good. These bans force investors to file complaints with stock exchanges and seek help in recovering their losses.

“Every expulsion should call for more checks to be built into the system,” said Dr Tejinder Singh Rawal, a Chartered Accountant, on a phone-call. “We have one of the oldest stock exchanges in the world but we have failed to create long-term investors.’’

The exchange reported nearly 10,000 complaints in the financial year ended March 2021, down from a record high of over 24,000 in the previous year, according to data compiled from NSE.

Even after frequent audits, complicated transactions and unscrupulous auditors can help fraudulent companies escape detection, said Dr. Rawal. “An auditor is a watchdog, not a bloodhound.”

An auditor is a watchdog, not a bloodhound

Dr Tejinder Singh Rawal, Chartered Accountant and Author of Loads of Money: Guide to Intelligent Stock Market Investing

“This scam has taken us 11 years back,” said a Kolkata-based doctor who had invested Rs 26 lakhs in Guiness Securities Limited (GSL), the first broker NSE expelled in FY 2019-20. The Securities and Exchange Board of India (SEBI) banned GSL from the securities market for misusing clients’ shares against their interests, the regulator said in a July 31, 2019 order.

The NSE Investor Protection Fund Trust offered to pay her Rs 4 lakh. She spoke to The Bottomline via phone-call and requested anonymity, fearing she might not get her money back.

“There is a little due diligence one can do before engaging with a stock brokerage,” said Mohit Mehra, Business Analyst at Zerodha, India’s top broker by number of clients. Investors can only check if there are any adverse reports about the broker, he added.