Utkarsh Hathi & Vaeshnavi Kasthuril

1 February, 2025

India’s fast-moving consumer goods (FMCG) shares gained after the Finance Minister Nirmala Sitharaman announced income tax relief for the middle class in the budget for fiscal 2026.

The FY26 Union Budget proposed making normal income up to Rs 12 lakh tax-free under the new tax regime to boost consumer spending. High prices and low real wages had led to a slump in consumer spending in 2024. Auto and FMCG sales had declined due to an economic slowdown in fiscal 2025.

The Nifty FMCG index surged by over 2000 points on Saturday, with 14 of the 15 companies in the index gaining after the budget presentation. Maruti Suzuki International Limited (MSIL), Hindustan Unilever, ITC, Mahindra & Mahindra, Marico, and Titan were among the top gainers.

Analysts expect the tax relief to benefit FMCG, Auto and Retail companies. “This budget is more consumption driven,” said Pratik Prajapati, an equity analyst at Motilal Oswal Financial Services.

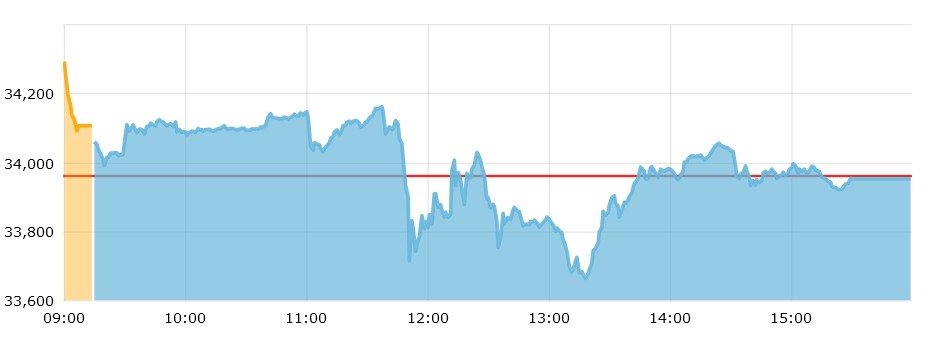

The NSE Nifty 50 index fell by 10.11% to close 26.25 points lower than yesterday, at 3:30 p.m. Indian Standard Time (IST), while the BSE Sensex rose by 5.39 points. The Sensex and Nifty had opened with gains on Saturday and traded in positive during the budget presentation.

The BSE benchmark index declined in the afternoon trade after the budget speech ended, as infrastructure and power stocks slumped due to lower-than-expected capital expenditure proposed in the budget. Larsen & Toubro (L&T), Power Grid, Tata Steel, and State Bank of India (SBI) were major losers among the blue-chip stocks, dragging the indices lower.

Corporates were expecting things from the budget, but not much has changed,” said Shirish Pardeshi, Co-head of research at Centrum Broking Limited.

The stock market, which is traditionally closed on Saturdays, remained open due to the budget announcement.